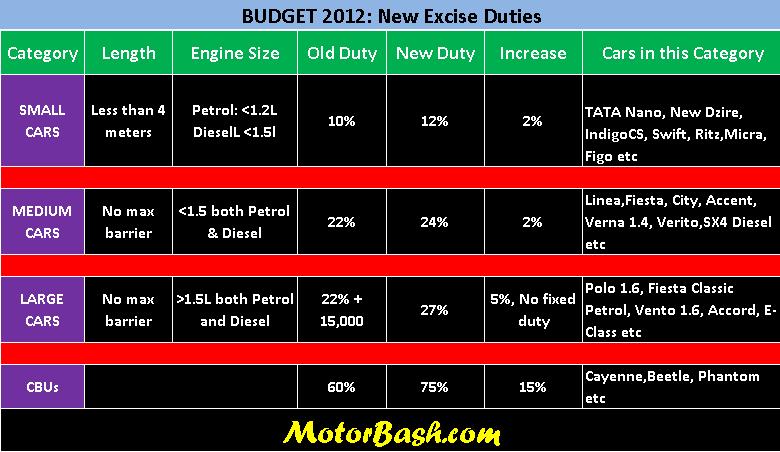

As they say, every cloud has a silver lining; the cloud here is the added Excise Duty across all vehicles! Let’s see what is the new categorization by the government and understand by how much has it increased.

Our Government doesn’t understand how many horses are pumped by an engine, what it best understands is the size of a car and the engine’s displacement. Hence, based on this understanding the classification and increase in duty are as follows:

SMALL CARS:

Length: Less than 4 meters

Engine Displacement: Lesser than 1200cc for Petrol and Lesser than 1500cc for Diesel

Old Excise Duty: 10%

New Excise Duty: 12%

Increase: 2%

Some cars in this Segment: This is the lowest excise point and comprise of the highest selling segment in India which comprise of cars as small as TATA Nano and as big as New shortened Dzire and include Swift, i20, Ritz, Nissan Micra, Figo and the likes in between.

Price Increase: Based on their pricing, cars in this segment are expected to cost more (upto) Rs 20,000 for the premium ones.

MEDIUM CARS

Length: No max barrier

Engine Displacement: Lesser than 1500cc for both Petrol & Diesel

Old Excise Duty: 22%

New Excise Duty: 24%

Increase: 2%

Some cars in this segment: Majority of entry level to select premium sedan cars fall in this category. So cars like Linea, new Fiesta, Honda City, Hyundai Accent, Verna 1.4 Petrol and Diesel, Verio, SX4 Diesel etc make this segmentation.

If you notice, there are some funny points to note:

– Though new Fiesta falls in this category by a whisker, the Fiesta Classic Petrol goes to the next slab with its engine size of 1596cc exceeding the bracket

– This segment also includes cars as big as Renault Fluence Diesel with its 1461cc engine and Toyota Corolla Altis with its 1364cc diesel engine.

– Verna’s most selling 1.6 liter diesel and petrol engines go over this bracket.

Price Increase: Prices of these cars are expected to go up by 12000 to 20000

LARGE CARS

Length: No max barrier

Engine Displacement: Greater than 1500cc for both Petrol and Diesel

Old Excise Duty: 22% + Rs 15,000 (fixed duty)

New Excise Duty: 27%

Increase: 5%, No fixed duty

Some Cars in this Category: So cars which do not fall in the above category come right over here. It starts from cars as small as Fiesta Classic Petrol, Vento 1.6 (Petrol and Diesel) and go all the way to cars like Honda Accord, Mercedes E-Class among others.

Points to Note:

– Volkswagen Polo 1.6 falls in this slab

– Smaller cars like Polo 1.6 and Fiesta Classic with a price tag of 7 Lakhs and thereabouts get taxed exactly equal to over 40 Lakh Mercedes E-Class.

Price Hike: Hikes of between 70k to 5 Laks for the S-Class and 7 series

FULLY IMPORTED CARS:

This includes all luxury cars which are imported as CBUs – Completely Build Units from foreign destinations.

Old Customs Duty : 60%

New Customs Duty: 75%

Increase: 15%

The already costly exotic beauties like the Cayenne, Beetle, and Phantom etc all to be taxed more

GREENER CARS:

This includes hybrid and electric cars like the Mahindra Reva which get a boost. Excise Duty on replacement batteries and other parts have been reduced to 6% from the earlier 10%.

By,

Saad Khan

Editor MotorBash

Major Source: TEAM-BHP.COM