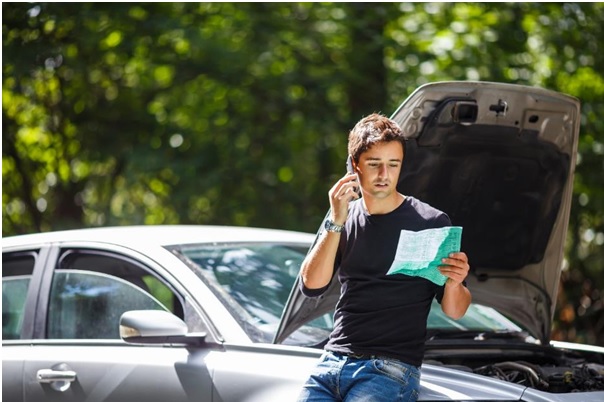

Buying a car is an exciting experience, as you go through the process of selecting the brand, model, color, and so many other things. At each step, you think from all perspectives and then zero down on the final decision. However, when it comes to purchasing car insurance, you often overlook many things, mainly the number of accidents that occur in India on an average. You think that it entails of complicated terms and leave it to your car dealer. Considering that car insurance plays a crucial role in keeping your vehicle secure, you must check all aspects properly.

You can even buy car insurance online as that will enable you to get all the information just with a click, and help you compare different plans. There are also some lesser-known facts about car insurance that you may like to know to make the best decision. Read below to find out some of these facts:

- Car Profile Influences Insurance Premium

When you buy car insurance online, you must know that your car profile plays an important role. The car profile would include that firstly, what type of car it is, meaning hatchback, sedan, SUV or a luxury car. It also includes how old the car is, if it has any safety and theft devices fitted and other such things. Different insurers may consider several aspects. Based on the car profile, they usually categorize cars into high profile cars, meaning ones that are more likely to be stolen and, low profile cars that have low risk.

It is advisable that when you buy car insurance online or switch from one insurer to another, you share all the vital details related to the car. Doing this will ensure that you don’t have to face claim rejection later in case of an unfortunate incident.

2. Credit Score Also Impacts Your Risk Score

Most policy buyers are not aware that their credit score also affects the risk score. Insurers offer you coverage at a specific rate, which is based on your risk profile. If you make all bill payments timely and have had the same credit accounts for some time, the insurer will presume that you’ll be a steady and firm policyholder. It can also affect the premium of your car insurance policy. So, now you must know that the insurer also maintains a proper record of insurance risk score of all policyholders.

3. Car’s Colour Has No Role

Many people often have this misconception that colour also has a bearing on the insurance coverage and premium amount. However, even though insurers don’t share much about this aspect, colour does not have any significant role in insurance. Therefore, you can go ahead and buy your dream car in whatever colour you prefer.

4. Personal Items or Assets During Car Theft Less Likely to be Covered

Most people carry expensive items or assets like laptops, gadgets and other belongings with them while driving to work or otherwise. In case the car gets stolen, the policy does not offer coverage for the items kept in the car. That is why it is crucial that when you buy car insurance online, you check all the inclusion as well as exclusion terms carefully.

5. Coverage for Consumables Expenses

You may or may not know, but if you meet with an unfortunate happening such as an accident, your insurance plan may also provide you with the cost of replenishing or replacing specific consumables. However, this is usually offered as a rider, and availing to this benefit when you buy car insurance online can prove to be of considerable support. Reputable car insurers like Tata AIG provide consumables cover that compensates you for the cost of lubricants, brake oil, oil filter, air conditioner gas, engine oil, nut and bolt and several other things. However, it comes with a condition that the car must be repaired at the insurer’s network garage.

Now that you know some lesser-known facts about car insurance, you must buy car insurance online after considering all aspects. Secure your car with an insurance plan that provides comprehensive coverage, so that you can enjoy peace of mind against the financial burden that comes with any unforeseen loss or damage.